Rapid expansion of low-cost airlines

- Record levels in the number of European and intercontinental connections

- Eurowings is the largest supplier in Germany with 52 percent of the market share

- Prices continue to fall

- Focus: aviation, transport

The cost of low-price air tickets fell once again in the 2017 summer season, accompanied by a massive expansion of low-cost airlines in Germany. Eurowings had already expanded its network even before the collapse of Air Berlin by taking over numerous aircraft and establishing a new hub in Munich. Eurowings is the market leader in Germany, holding a share of 52 percent. Its competitor Ryanair also expanded its fleet significantly by almost 14 percent and is the largest low-cost carrier in Europe, accounting for 25 percent of the market. The number of long-haul flights also grew substantially thanks to new strategies and aircraft models. These are the findings of the recently published 'Low Cost Monitor 2/2017' by the German Aerospace Center (Deutsches Zentrum für Luft- und Raumfahrt; DLR). The report has been published every spring and autumn since 2006.

Over 100 new routes departing from Germany

"As the forerunner of bargain air tickets, the range of flights offered by Ryanair has consolidated in second place in the ranking of low-cost carriers in Germany, offering a record number of 243 routes," says lead investigator Peter Berster from the DLR Institute of Air Transport and Airport Research in Cologne. “The Irish airline recorded more than 50 new routes departing Germany, compared to last year,” Berster continues. "Ahead by some distance is Eurowings/Germanwings, which offers 368 different routes within and from Germany, and has included around 50 new routes in its flight schedule, whereby Eurowings also operates a number of Lufthansa connections departing from Munich." EasyJet offers around 90 routes, while Wizz has 73. Overall, a significant growth of 14.8 percent from 700 to 802 routes was recorded in low-cost air transport departing from Germany. Passengers flying to destinations in Spain, Italy or Greece, in particular, benefit from this development. The low-cost segment now accounts for 25 percent of air transport from German airports.

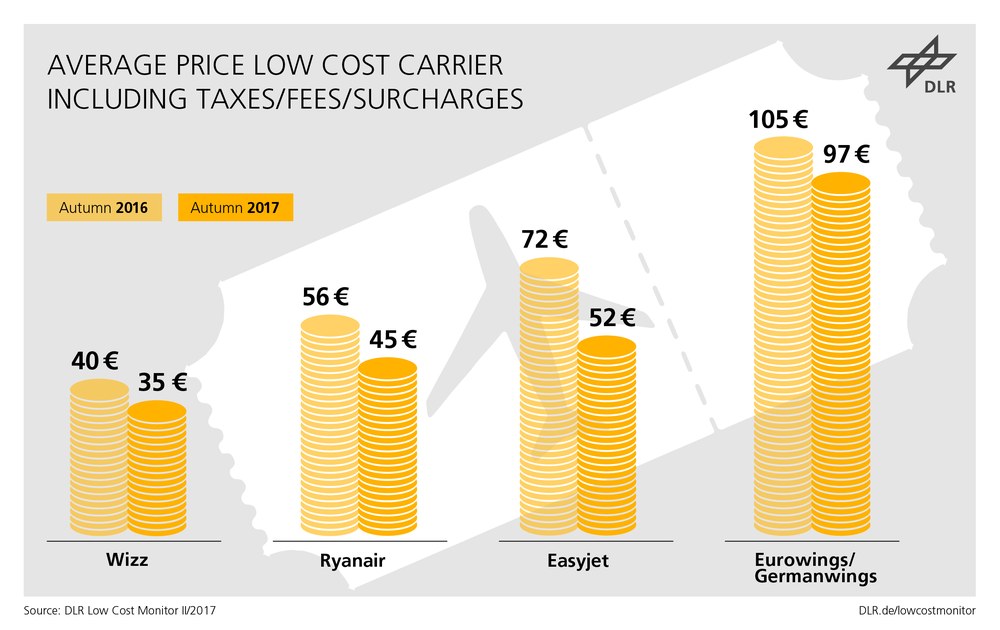

Prices fall to their lowest level

"The prices offered by low-cost carriers have continued to fall compared to last year due to the persistently fast-moving market," explains Berster. "This autumn, the identified price range fell to its lowest level to between 35 and 97 euro, after 40 to 105 euros in autumn 2016 and 45 to 115 euros in autumn 2015.” The reviewed prices remain low due to the continued availability of inexpensive kerosene and sustained competition with more than one low-cost carrier on now almost 100 routes departing Germany. Despite increasing their presence at major airports once again, Ryanair and Wizz have lowered their prices compared to last year and hence increased the trend toward falling ticket prices," says Berster. "How the takeover of Air Berlin will affect price development in the upcoming winter season remains to be seen." The quoted price range reflects the gross average ticket price for a representative selection of routes serviced by the most significant low-cost airlines in Germany, namely Eurowings/Germanwings, Ryanair, EasyJet and Wizz. The Low Cost Monitor determines the average prices based on a variety of advance booking periods, ranging from one day to three months.

Berlin-Schönefeld and Düsseldorf experience growth, Nuremberg doubles its figures

The increase in low-cost services at the two major airports of Berlin-Schönefeld and Dusseldorf is remarkable. "The massive increase in Ryanair’s commitment has led to a 16 percent growth at Berlin-Schönefeld, which now records 705 take-offs per week," explains Berster. "Dusseldorf Airport has also seen a substantial increase, partly due to the expansion of services by Eurowings and flyBe, as well as the market entry by Norwegian, which raised the number of weekly departures from 640 to 740." Nuremberg experienced a particularly strong growth, with an increase from 63 take-offs in summer 2016 to 143 in the same period this year. "The key factor for this is the dynamic growth by Ryanair and Eurowings, who have increased their number of weekly flights from 11 to 58 and from 40 to 60, respectively," Berster continues. Nuremberg therefore has a low-cost share of around 30 percent. This year, Ryanair and Wizz have started flying from Frankfurt Airport. Across Europe, the airports in Barcelona, London and Dublin score the highest points with the largest proportion of low-cost services.

Worldwide budget flights from Europe

Norwegian and Eurowings are investing significantly in expanding their range of low-cost air tickets in the long-haul segment. The Scandinavian low-cost carrier even doubled its number of intercontinental flights compared to last year, targeting passengers accustomed to travelling with the classic alliance airlines from major airports in London, Paris, Copenhagen and Stockholm. Modern, smaller aircraft are now also being deployed to service secondary airports on both sides of the Atlantic, including Edinburgh in Europe or Providence in the United States. Eurowings joined the market in November 2015, offering flights to Asia and America. Until now, it has operated low-cost flights from Cologne/Bonn Airport without competition. Moreover, Eurowings plans to service destinations in the Caribbean when it takes over Air Berlin’s long-haul flights from Dusseldorf in November 2017.

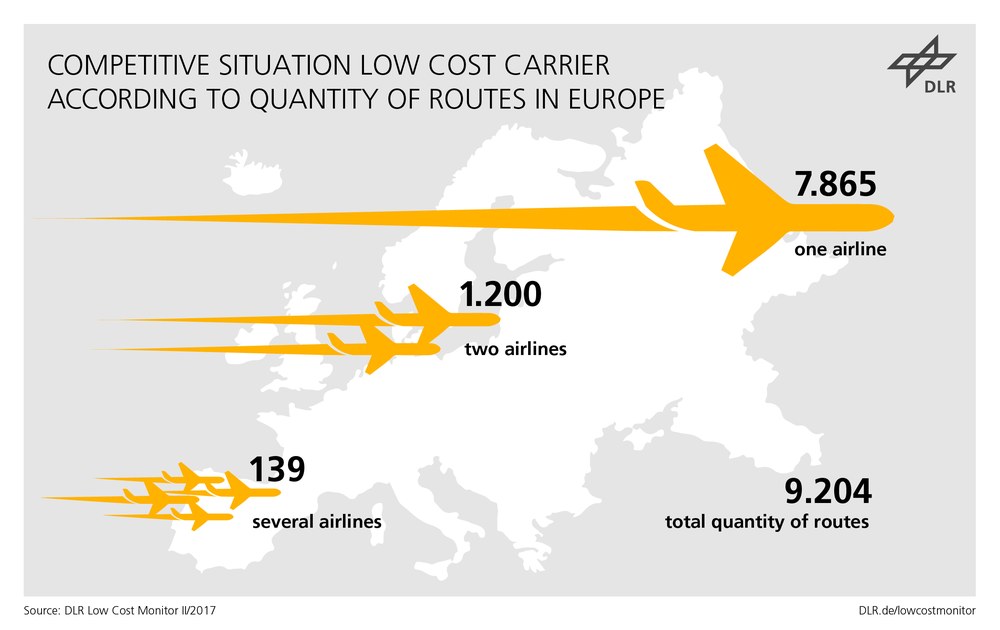

Ryanair and EasyJet continue to strengthen their market leadership Europe-wide. Ryanair now supports almost 3000 connections on the continent, followed by EasyJet with just under 1600 routes. Competition between low-cost carriers in Europe continues to intensify. At present, over 1300 routes are serviced by two or more providers. To manage its expansion in capacities, Ryanair now has a uniform fleet of over 400 aircraft of the 189-seater Boeing 737 type, which is 14 percent more than last year. EasyJet expanded its own fleet by 10 percent in the same period. Norwegian has also added a significant number of aircraft, including eighteen of Boeing’s modern long-haul jet type 787, which are used for intercontinental transport to Asia and America, in addition to its 120 B737 aircraft. Entirely new this summer are aircraft of the Boeing 737Max8 type, a long-haul version of the Boeing 737, which enables intercontinental flights from smaller airports in particular.

Low-cost and traditional airline operations

The airlines frequently apply very heterogeneous methods to structuring their low-cost services. Hence, only very few distinguishing criteria for the low-cost market segment can be defined: they include a low price, its general availability or direct sales via the Internet. Airlines are revealing an increasing tendency to apply hybrid business models. While Ryanair is basing more of its services at major airports and is attempting to attract premium customers by offering optional extra packages, charter carriers and established airlines are increasingly tapping into the market for low-cost air transport by deploying subsidiaries or by including low-cost deals into their own range. By 2017, Lufthansa had outsourced all its domestic German and European flights – apart from the services at its hub in Frankfurt – to the subsidiary Germanwings, which itself has been integrated within the Lufthansa Eurowings subsidiary since the start of November 2015.

The airlines analysed by DLR in the Low Cost Monitor are not identified based on their business model; instead they are companies that offer a large number of services in the low-price segment of the market overall. Hybrid business models are commonplace, so it is not possible to infer any clear, additional statements on the respective business models. Low prices, their general availability and the significant variance between the cheapest and most expensive price offered on one route, depending on the period of advance booking, are typical characteristics of the low-cost price segment. The findings quoted in the study are based on data acquired in a reference week in July 2017.

Not included in the Low Cost Monitor is the airline Air Berlin, which filed for bankruptcy in August 2017. This will lead to substantial changes in the market after summer 2017, when Air Berlin flights will come to an end and many of its aircraft will additionally be incorporated within the Eurowings services. Meanwhile, Ryanair is struggling with internal issues and has reduced its winter schedule on short notice.